If you are a homeowner looking to release capital from your property, you may consider an equity release plan. But what age do you need to be to qualify for an equity release?

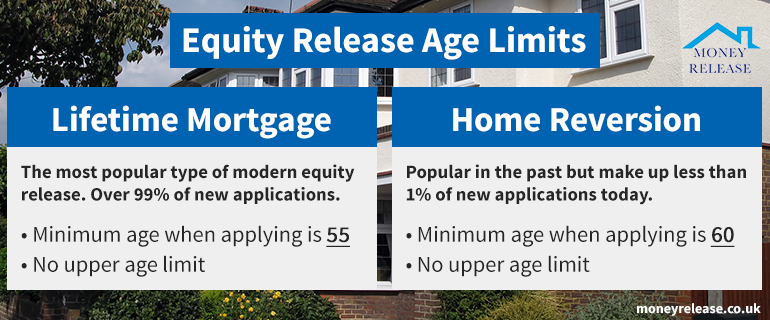

Equity release plans are available to homeowners from age 55, and there is no upper age limit. Not all providers lend at all ages, but most plans are available to applicants aged 60 to 85. For joint applications, providers will consider both ages; You may make a sole application if one applicant is too young.

If all homeowners are younger than 55, but you would like to release some of your property's equity, you may do so using other financial products that require monthly payments. We will explore some of these options, including remortgaging, later in this guide.

Important! Age limits are only imposed when making an equity release application. Once an equity release plan is in place, it will be able to run for as long as you need it.

To start with, let's explore the different types of equity release plan and their respective age limits.

Let's dive a little deeper into each type of equity release.

The most popular form of modern equity release is a lifetime mortgage; they equate to over 99% of the equity release plans that I recommend. What are the age limits for a lifetime mortgage?

Lifetime mortgages are available to borrowers aged 55 and above. There are no upper age limits for lifetime mortgages. At age 55 you can release up to 23.95% of your property value, increasing each year you age. The maximum percentage that you can release from your home is capped at 55%.

While you qualify for a lifetime mortgage at age 55, the number of equity release plans available will be restricted. Similarly, the number of plans available to applicants over 85 also become restricted.

You may be wondering if different lifetime mortgage lenders offer plans at different ages - I know that this was one of the first questions I had when I started advising.

I have looked at all the lifetime mortgages currently available (there are over 200), and summarised by lender, the age limits imposed.

Let's look at the minimum and maximum ages for lifetime mortgage applicants by the lender:

| Lifetime Mortgage Lender |

Minimum Applicant Age |

Maximum Applicant Age |

| Aviva |

55 |

No upper age limit |

| Canada Life |

55 |

90 |

| Hodge |

55 |

88 |

| Just |

55 |

No upper age limit |

| LV |

60 |

95 |

| More2Life |

55 |

No upper age limit |

| OneFamily |

55 |

100 |

| Pure Retirement |

55 |

No upper age limit |

Please note: Some lifetime mortgage lenders offer multiple plans, with some restricted to certain aged applicants. The table above shows a summary of lifetime mortgages each equity release lender provides.

Home reversion plans were popular in the 1990s, and they are often not suitable anymore. But there are some circumstances where they could be; especially as they can provide you with higher cash amounts than lifetime mortgages.

We have already discussed that lifetime mortgages are available from age 55, but do Home Reversion plans differ?

Home Reversion plans are available to homeowners from age 60. There are no upper age limits with Home Reversion Plans. Home Reversion plans were a popular form of equity release; However, lifetime mortgages are now the most popular and are available from age 55.

The number of home reversion plan providers have become less over recent years. But there are still a couple of Home Reversion providers offering plans. Let's look at the age limits by Home Reversion provider:

| Home Reversion Provider |

Minimum Applicant Age |

Maximum Applicant Age |

| Retirement Bridge |

60 |

No upper age limit |

| Crown |

70 |

No upper age limit |

While home reversion plans can provide you with more cash than a lifetime mortgage, the biggest drawback with a home reversion is that it involves selling part or all of your home. Not only this, but the cash that you receive will be less than the property's market value. So don't be surprised if your equity release advisor recommends you a lifetime mortgage instead!

Now that we have explored the age limits associated with equity release plans, we should consider how your age impacts the amount of money that you can release.

Lifetime mortgages start from age 55, but you may be interested in finding out how much you can borrow, depending on your age?

I have created an entire guide on calculating the maximum equity release, which includes the impact of your age and property value.

Let's look at a summary of the maximum percentage of your property value that you can borrow, depending on your age.

| Age of youngest homeowner |

Maximum percentage of property value which can be released (LTV) with a lifetime mortgage (equity release) |

| Standard terms |

Medically enhanced |

| 55 |

24.0% |

27.3% |

| 56 |

25.0% |

28.2% |

| 57 |

26.0% |

29.3% |

| 58 |

27.1% |

30.2% |

| 59 |

28.1% |

31.3% |

| 60 |

30.9% |

34.1% |

| 61 |

32.5% |

35.7% |

| 62 |

33.5% |

36.6% |

| 63 |

34.5% |

37.3% |

| 64 |

35.5% |

38.1% |

| 65 |

36.6% |

39.3% |

| 66 |

37.6% |

40.6% |

| 67 |

38.1% |

41.5% |

| 68 |

39.1% |

42.5% |

| 69 |

40.2% |

43.1% |

| 70 |

41.5% |

43.8% |

| 71 |

42.7% |

45.2% |

| 72 |

44.0% |

46.3% |

| 73 |

45.2% |

47.5% |

| 74 |

46.3% |

48.6% |

| 75 |

47.7% |

49.1% |

| 76 |

47.0% |

49.3% |

| 77 |

48.1% |

50.5% |

| 78 |

49.0% |

50.6% |

| 79 |

49.6% |

51.0% |

| 80+ |

50.5% |

51.5% |

As you can see in the table above, the older that you are, the larger your lifetime mortgage can be!

Lifetime mortgage lenders assign a percentage release amount (or Loan To Value) for each plan by age. The older that you are, the higher the maximum equity release can be. But it doesn't stop there.

Although your age doesn't directly affect the interest rate, it does affect the maximum amount you can borrow. This, in turn, affects the interest rate, as typically the closer you are borrowing to the maximum amount available, the higher the interest rate.

Let's look at an example:

At age 55, if you wanted to release 20.00% of your property value, the best interest rate would be 7.22% (AER).

At age 75, if you wanted to release 20.00% of your property value, the best interest rate would be 5.77% (AER).

Following the MMR in 2014, lenders are much more tightly governed by the affordability of mortgages that they offer. This has seen a drastic decrease in the number of interest-only mortgages on the market.

In 2018, the Financial Conduct Authority (FCA) re-categorised Retirement Interest Only mortgages (RIOs). Moving them outside of equity release and into the mainstream mortgage bracket. This has led to an increase in the number of interest-only mortgage offerings into retirement.

With a RIO, you borrow money that is secured on your property as a mortgage. You make monthly payments of the interest charges, but the capital lump-sum borrowed is not repayable until you either pass away or move into permanent long-term care.

RIOs can be a great way to release money from your home whilst making monthly interest payments. The interest rate will be much lower than a credit card or unsecured loan too.

For those who have sufficient income, a RIO could be a great way to "plug the gap" between an existing interest-only mortgage, and a lifetime mortgage.

I am often approached by people who are under 55 and wish to take equity release. What options do they have available to them?

Sole equity release applications can be made where one homeowner is over 55 and the other is under 55. Alternatively, other financial products can be used until you reach 55.

If there are no homeowners aged 55 and above, the most common way to release equity from your home is to consider remortgaging. Mandatory monthly payments will be required, but with mortgage interest rates holding low, it may cost you less than you think!

You may even be able to replace any existing mortgage with another which costs you less each month, while also providing you with the release of equity that you need.

We can help you source another financial product that best suits your needs. Use our equity release calculator and complete the contact form on the confirmation page.

If you have further questions, why not speak with one of our qualified advisors?

Call us on 0207 158 0881 or use our online form to book your FREE consultation.

While a qualified equity release advisor has written this guide, it is not intended to be used as financial nor legal advice and should not be relied upon.

To understand the full features and risks of an Equity Release plan, ask for a personalised illustration.

Did this article answer your question?

If you found this article interesting, why not share it with your friends?

Simply click on the icons below to share.